Framework 153 Start Up

Introduction

Themes

NB The word product refers to 'product and/or service'

Use the 6 questions below to explore following themes:

i) Who is your customer?

ii) What can you do for your customer?

iii) How does your customer acquire your product?

iv) How do you make money from your product?

v) How do you design or build a product?

vi) How do you scale your business?

Bill Aulet, 2013

Why do people start a new venture? Answers include:

i) having an idea, ie a way to improve something or do something better than the status quo.

ii) technological breakthrough

iii) passion to be an entrepreneur.

More often than not, people invent things to help solve a problem they have personally experienced (user entrepreneurship) and/or have identified a customer pain that the customer will pay to fix.

To be a successful entrepreneur, you need to know your own strengths and weaknesses plus what you are passionate about.

To successfully develop your idea, you need to follow 24 steps discussed below, especially focusing on what is most important.

Steps for a successful start-up (24)

1. Market segmentation (build your organisation around customers' needs, not products; create a profile of the target customer, ie end users (primary customers) and/or economic buyers (secondary customers); initial focus is on the primary customers.

"...start by brainstorming a wide variety of market opportunities..... Start talking to customers to see what they think. Analyse your market potential and look at industries were you can market your product. Buy the list of people in that industry that might benefit from your product..."

Bill Aulet, 2013

Narrow the field down to those with the greatest potential, by answering the following questions:

"...- Can the customer afford the product?

- Can the customer be reached directly, without going through an intermediary?

- Does the customer have a good reason to buy your product?

- Can you deliver your product now?

- Is there competition?

- Once you get this segment, can you get other segments?

- Is the market a good match for the goals and values of the founding team?..."

Bill Aulet, 2013

When doing your primary market research, listen to potential customers' ideas and understand the pain points - don't try to sell anything at this stage.

"...in each market, you're trying to understand several categories of things. You want to know who the end user is and understand how your product will be used. What are the benefits of your product? Evaluate whether anything else is required to use your product. Identify influential (lead) customers, and predict who your likely partners will be. Figure out the market characteristics, including size. Understand your competition. Consider other factors that you need to understand, given your circumstances..."

Bill Aulet, 2013

It is crucial to start the process with customers and work everything backwards from them.)

2. Electing a beachhead market (BHM) (select one market opportunity to start with; if possible, best to start with a small market that has no competition; need to consider the variables listed step 1:

"... Does the customer have money? Are the customers accessible to your sales force? Do they have a good reason to buy your product? Are you able to deliver a whole product to them? Is it competitive in this market? If you win this market, will it help you with the next one?..."

Bill Aulet, 2013

It is of the most importance to start and focus on this market exclusively; once you have captured it, then look at other segments, markets, etc.

BHM needs to meet these conditions:

"...- all customers buy similar products

- customers have similar sales cycles and expectations, so that they can be served by similar strategies

- customers are networked so that information and opinions can be shared among them..."

Bill Aulet, 2013)

3. Build an end-user profile (focus on understanding the customer via market research; each customer has 2 roles:

- end-user of the product

- decision-making, ie makes the decision to purchase; this role can be further divided

"...a) The champion wants the customer to purchase the product

b) The primary economic buyer has the power to authorise the purchase

c) Other people who might affect the purchase, including people such as influencers, veto power, purchasing department, etc..."

Bill Aulet, 2013

Part of understanding customers involves close communication with them, ie

"...You will talk to, observe, and interact with target customers in a continuous process of information gathering..."

Bill Aulet, 2013

Ideally, choose a specific demographic within your BHM; realise not everyone in your market is the same and the BHM can't be all things to all people.

Develop an end user profile, which could include characteristics including gender, age, income, location, motivation, lifestyle, etc.)

4. Calculate the total addressable market (TAM) size for the BHM (TAM = "...an estimate of the amount of money available in your beachhead market if you achieve 100% market share..."

QUT, 2023

TAM is the sum of the expected customer annual spend multiplied by the number of estimated total customers.

Need to determine how many people fit the end-user profile by using:

- bottom-up analysis, ie counting the number of potential end user and their customers using customer lists, trade membership rolls, etc; it is very specific

- top-down analysis, ie use demographics to figure out the size of the market plus conduct secondary research like industry reports to determine the number of end users that fit your profile; it is more general.

Then determine how much each customer is likely to spend on your product and estimate how much value your product will create for them.)

5. Profile the persona for BHM (develop a real profile of a primary customer; information collected should include

"...place and date of birth; where they grew up; their education; what their family is like; the job and related metrics, such as income and job performance. Also, list the persona's purchasing criteria

- How do they prioritise what they want?

- What is it that they worry about the most?

- What are their important goals?..."

Bill Aulet, 2013

Keep updating the profile as you get more information.This should help your staff remain customer focussed and and the profile serves as a touchstone for all decisions going forward.)

6. Full life cycle use case (using primary market research to determine how your target customers will use your product and what they think about it; see it from the customer's point of view, not just your own.

This case study can explain

"... How your products are currently meeting the persona's needs. Describe how a customer first finds out about your product. Explore how they buy the product, use the product, and whether they tell their friends about it. Be as detailed as you can possibly be..."

Bill Aulet, 2013

This will help you understand and describe how your product will fit into the persona's workflow; it will provide valuable information for future customers and understanding of potential barriers to adaptation from a sales perspective.

NB

"...if you want your product to be a success, it will, first and foremost, have to appeal to the customer..."

Bill Aulet, 2013)

7. High-level product specification (once you have defined and analysed the customer, start to focus on the product by creating high-level product specifications; you can develop a general visual description of the product, such as a brochure, that shows what the product will looks like; not a prototype (this will come later).

Use it to get feedback from the customer; be prepared to refine has required.

You need to make sure your staff members have a common agreement on what the product is.)

8. Quantify the value proposition (it shows how the customer's value benefits from your product, ie focusing on their needs, not on technology or features

"...will help you quantify how well the product aligns with the persona's top priority (or priorities)..."

Bill Aulet, 2013

Identify and contrast the differences between the current situation (as is) and the potential one (possibility) when using your product; it needs to be credible, ie

"...Don't promise what you can't deliver..."

Bill Aulet, 2013

This is an important part of launching a product, ie summarise the value your product will create for the target customers - they will buy based on value; need to be clear when providing the value assessment.)

9. Identify your next 10 customers (create a list of the next 10 customers based on your experience with the persona who is closely resembling the end user profile; use them as a basis for validating the persona and all the assumptions you have made so far.

As this is an information-collecting exercise, not sales exercise, contact the customers identified and get feedback about possible uses of your product, ie testing if your assumptions and hypotheses are correct and/or need improving; there is much value in negative feedback.

NB "...you are there to listen to the customer, not to convince them of anything..."

Bill Aulet, 2013)

10. Identify your core (determine your competitive advantage, ie what you do better than anyone else; what differentiates you from everyone else, ie what other organisations are unable to provide to customers; ideally, it is very hard to duplicate; some examples of core:

- network effect (you dominate your field by reaching a critical mass, so customers stay with you and new customers gravitate to you)

- outstanding customer service (owing to this, customers stay with you rather than shopping elsewhere; this reduces churn and expenses; satisfied customers are more likely tell others about the good service you provide, which will attract new customers)

- low costs ( this can be the deciding feature in a product)

- user experience (where staff are focused on continuous improvement of user experience)

NB there are things in which your organisation can have a market advantage but are not necessarily core, such as innovative technologies, first mover advantage, etc.

Thus need to have a clear definition and understanding of your core competencies and focus on these to build and reinforce.)

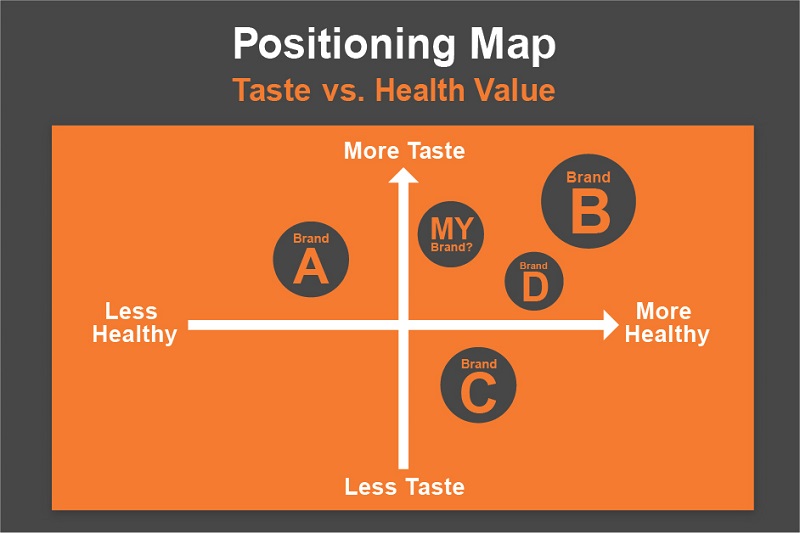

11) Chart your competitive position (you analyse how well you and competitors satisfy your customers' key priorities - see example below which considers variables such as 'tastes vs health value'; 'my brand' is well-positioned on taste and health value but brand B is ahead on both variables, which would be a concern.

.

(source: https://innismaggiore.com/news/blog/positioning-map-can-reveal-your-competitive-advantage/)

Ideally, you want to show that you can meet customers' priorities better than the competition and/or existing products, ie the product should be the top right-hand corner of the chart; if you cannot demonstrate this, you need to re-evaluate your market selection and core.

This is a qualitative value proposition, not quantitative.

This represents visually your position relative to other alternatives on a couple of variables.

NB The customer's focus is on benefits relative to their priorities; they are only interested in how you can help them reach the benefits and their priorities).

12. Determine decision-making unit (DMU) (identify all people in your customer organisations who are involved in making decisions about purchasing your product; this could include the

- prime economic buyer, ie the person who pays or signs off on paying (the ultimate decision maker)

- champion or advocate, ie the person who wants to buy the product

- influencer, ie the person with credibility and who is respected within the organisation, irrespective of their position in the organisational chart

- end user, ie person who will be use the product.

Need to understand who makes the decision to buy and how to motivate, persuade, etc to do so.

Additionally, be aware and careful of people with 'veto power'.

NB This is the start of the process to determine the cost of customer acquisition.)

13. Map the process to acquire a paying customer (once decision-making identified,

"...you need to understand the decision-making process so you can make your product fit that process. How long will it take for delivery and payment, from the time you present your product to the purchaser? How much will it cost you to acquire new customers? Finally, what, if any, obstacles stand in the way of making the sale?..."

Bill Aulet, 2013

This involves detailing or mapping how the members of the DMU make decisions to buy your product; it should include things such as lead generation, access to influencers, purchasing, sales cycles, installations, complying with standards and legal regulations, etc; these items will have sub-components.

For each component, identify the key DMU players, their influences and budgetary authority; detail how you will be paid, who has purchasing authority and where costs will be allocated, ie operating or capital budgets; timing of payments, etc.

This map will help you identify the length of the sales cycle and critical bottlenecks or obstacles or pitfalls in the sales process.)

14. Calculate the total addressable market (TAM) size of follow-on markets (consider other markets beyond the 'beachhead'; calculate revenue from potential markets after you are successful in your beachhead market; there are 2 kinds of follow-on markets:

i) upselling (selling new products to the same customer; it is cost-effective to sell them more products as you can leverage your positive relationship with them)

ii) selling current product to new customers or markets (this allows you to leverage your resources)

Ideally, dominate your beachhead before picking a follow-up market.)

15. Design a business model (review different ways to get paid for your products and explore how to best align with all stakeholders' interests, especially customers, ie think about it from the customer's point of view, eg what is the customer willing to do?; revisit all the above steps, like decision-making unit information, competitive advantages, core competencies, quantified value proposition, customer acquisition process, distribution channels, competition, etc)

(for more detail, see elsewhere in the knowledge base)

16. Set your pricing framework (experiment with different price points by estimating the lifetime value of an acquired customer and the cost of customer acquisition;

"...Price should be based on how much value the customer gets from your product, not on how much it costs to produce......you need to understand the customer's budget, and the DMU research and customer acquisition map will help you......pricing of competing solutions...."

Bill Aulet, 2013

NB Small changes in pricing can have a huge impact on your profitability.

17. Calculate the lifetime value of an acquired customer (LTV) (it is an estimate of the net present value of the total profits you could get from a new customer over the his/her lifetime; it includes factors such as revenue streams, costs, customer retention rates, gross margins, etc.

The LTV plus cost of customer acquisition (COCA) gives an indication of how much you are making; if your COCA is too high you won't make any money, irrespective of how high your sales volume is.

Calculate the present net value above cost of capital, ie

present value = profit x (1-cost of capital rate) x t

where "t' equals a number of years after year 0

To complete the unit economics, you now need to estimate and understand the drivers of LTV and it should get to at least 3X (COCA))

18. Map the sales process to acquire a customer

"...Map the sales process. Think about the sales channel you're going to use and how it will change over time. Consider factors such as how you intend to make sales and how you collect money. Pay attention to the length of the sales cycle...."

Bill Aulet, 2013

Look at client management; seek independent feedback on your map

19. Calculate the cost of customer acquisition (COCA) (COCA = how much will you spend on acquiring new customers; important factors in this calculation include costs such as salaries (especially sales & marketing, etc), marketing (promotional & advertising, etc including Internet, etc like social media, etc), etc; include both where successful or unsuccessful in securing customers.

For the new enterprises, the COCA is usually high and falls over time; look at short-term, medium-term & long-term strategies, especially those focused on maintaining existing clients and creating additional sales opportunities for them; focus on customers with highest LTV; be prepared to make adjustments as competitors emerge.)

20. Identify key assumptions (when starting a new business, you make a lot of assumptions about your product, your market, your customer, etc; these need to be tested by first identifying them (and their components) and understanding which ones are based upon research and/or assumptions like gross margins, DMU, etc))

21. Test key assumptions (this approach will allow you to understand which assumptions are valid and which ones are not; giving you time to adjust while the cost and time to do so is minimal; test, in a series of small and inexpensive experiments, each of the individual assumptions you have identified in step 20; some examples:

- check your cost projections (by seeing how much vendors charge for supplies)

- evaluate customer-based- assumptions (like whether they're willing to pay for your product) by asking how much they are willing to prepay, if they will sign a binding contract provide a letter of intent; this is best done face-to-face.

"...perhaps the most important assumptions to test our cost targets and how enthusiastic key customers are for your product. Testing assumptions complements the market-based research that you have already done. The combination of this data position allows you to create a product that could succeed..."

Bill Aulet, 2013

Do this before you begin to make investments in product development.)

22. Define minimal variable business product (MVBP) (based on tested, key assumptions, create an actual product, ie

"... Integrate your assumptions into a single system test to verify the minimal product which a customer will still pay. MVBP requirements include

i) the customer gets value from using the product

ii) the customer pays for the product

iii) the product is good enough to start a feedback loop, helping you change and improve the product so that you can make a better product..."

Bill Aulet, 2013

Sometimes you have more than one kind of customer and need to adjust for their particular needs. For example, a secondary customer pays for the product in exchange for access to the primary customer or for access to information about them.

Keep it simple and get the product into the customer's hands, as quickly as possible so that will start a feedback loop with the customer to help you to create better versions of the product.)

23. Show that the 'dogs will eat the dog food' (doing great research does not guarantee success in the marketplace; develop a prototype to be tested in the market place, ie do your assumptions work in the real world?

Are your customers advocates for your product as word of mouth is a very powerful marketing mechanism?

Continue collecting data on what happens, ie try to understand what is driving the trends and focus on data from the real world.)

24. Develop a product plan (based on the feedback from the prototype, fine tune your product for the market place, ie beachhead and follow-on markets; plans might vary between markets depending upon their uniqueness.)