Technique 2.103 Five Drivers as Part of Business Acumen

Introduction

Business acumen involves

"...Understanding how a business makes money and making good decisions around the money-making process..."

Mike Wright, 2023

Business acumen is a key priority for any organisation to remain viable; it consists of the following competencies: cultural, skills (soft and hard).

This technique gets everyone thinking about the business within a context of a common framework; it shows how everything ties back to financials; how understanding key business drivers helps make faster, smarter and more informed business decisions.

It leads onto more advanced concepts like enabling growth, reducing risk, etc

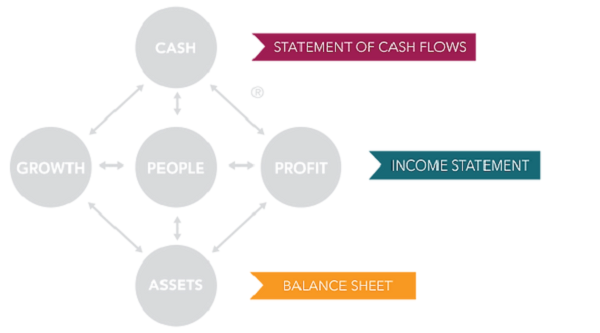

The 5 key business drivers are cash, profit, assets, growth and people (see below diagram how they fit into statement of cash flows, income statement and balance sheet.)

NB Employees need to know what is behind each of these drivers

(source: Acumen Learning, 2021)

It will help you understand how your organisation makes money; the following questions will help

- Is your company making more money than it did last year?

- Are you making more money than your competitors?

- Which products/services are outperforming?

- Which products/services are underperforming?

- What's the strategy to make more money going forward?

(source: Acumen Learning, 2021)

People with business acumen need to be aware and understand the challenges their clients are facing, not just the features and benefits of the products/services being offered. People with business acumen

"...Not only understand how their products fill a need for the client, they know the challenges that plague the client on a daily basis and offer solutions rather than peddle products..."

Acumen learning, 2021

Things that work against business acumen:

- lack of alignment (lack of alignment between strategic level decision-making and overarching goals of the business

"...people who proposed plans, projects or other ideas that don't align the business goals and priorities may not fully understand how the business makes money and how to make good decisions around the process..."

Mike Wright, 2023

- no rigour or depth to the budgeting process (numbers are misleading, ie don't make sense in terms of budget, strategic priorities, etc)

- poor turnover or retention rates (lack of business and financial acumen can cause higher than expected turnover and retention rates

"...employees who understand business and financial concepts are more likely to be engaged and committed to their work......employees with financial training were better able to understand the company's goals and strategies, and were more likely to feel a sense of ownership over their work. Conversely, employees who lacked financial knowledge were likely to feel disconnected from the company's goals and were less likely to see the relevance of their work. This can lead to a lack of motivation and a higher employee turnover. Plus, poor turnover retention rates can also signal a gap in business acumen..."

Australian Management Association as quoted by Mike Wright, 2023