Scenario Planning (more examples)

Developing Strategies in Turbulent Times

Introduction

Traditional strategic planning works best where stable environmental factors influencing future growth and profitability allow for relatively easy forecasting. However, in turbulent times, scenario planning is a better option.

A good example is the airline industry. From 1980 to 2000, the growth was relatively stable. However, the 9/11 terrorist attack, wars in Iraq and Afghanistan and now in Eastern Europe, oil price volatility, global financial crisis, environmental concerns, health/pandemic issues (SARS, COVID-19, etc), etc have emphasised the need for flexibility in planning and implementation. Need to

"...think of strategy-making as a continuous process that generates a living, dynamic plan..."

Michael Mankins et al, 2022

This requires much flexibility and agility using 5 step approach

1. Define extreme and plausible scenarios (look at a range of probable scenarios so that new and different ways to do things are explored.

For example, look at CMS energy - Michigan's largest electric and natural gas utility. Traditionally, it develops its strategic plan around price movement, ie coal and natural gas. Instead, it decided to look at 5 plausible scenarios:

i) business as usual (incrementally adding to current capacity)

ii) deregulation of markets (complete deregulation of interstate energy markets)

iii) elimination of the hub-and-spoke (point-to-point flows of power across state lines)

iv) decarbonisation (rapid increase in environmental regulations)

v) abundance of gas (new sources of low-cost natural gas developed)

This resulted in the company developing different concepts, ie

"...Identifying several no-regret moves, such as deleveraging CMS's balance sheet, improving customer advocacy to help manage regulatory risk, and finding ways to reduce costs of fuel......also saw the potential to reconfigure the company's generation portfolio according to the availability and cost of natural gas balanced against pressures for decarbonisation.....its traditional strategy of incrementally adding capacity was risky under the other scenarios. It would leave the company vulnerable to assault by regulators and competitors and the high potential changes in the market for electric power..."

NB In 2014 natural gas prices fell by around 70% - no one predicted this.

This approach allowed CMS Energy to be in the top decile of utilities in terms of shareholder return from 2015 to 2020.)

2. Identify strategic hedges and options (being flexible by using hedges and options so that decision-making can be delayed until more information is available; it has been used widely

"...As the cutting edge tool for valuing natural resources Investments, formulating new product-development plans, analysing R & D spending, making acquisitions, evaluating technology investments..."

Michael Mankins et al, 2022

Need to uncover strategies that allow organisations to hedge their bets while preserving valuable options for the future. For example, Walt Disney realised that streaming was threatening the viability of traditional cable and satellite services, so they acquired a stake in BAMTech (a global leader in direct-to-customer streaming technology and marketing services). This investment allowed them to launch Disney+ 2 years later. Furthermore, Disney acquired 21st-century Fox to gain access to Fox's extensive film library - a collection that would be valuable no matter which distribution model survived over the long term. This

"...led to a doubling of its market value between 2017 and 2020..."

Michael Mankins et al, 2022)

3. Run experiments before locking in investments (

"...small experiments are perfectly fine (in fact, encouraged), but such experiments to be tied to something very big to ensure that the test is worth running..."

Michael Mankins et al, 2022

It is a good way of testing ideas, concepts, etc that may have application in the marketplace.

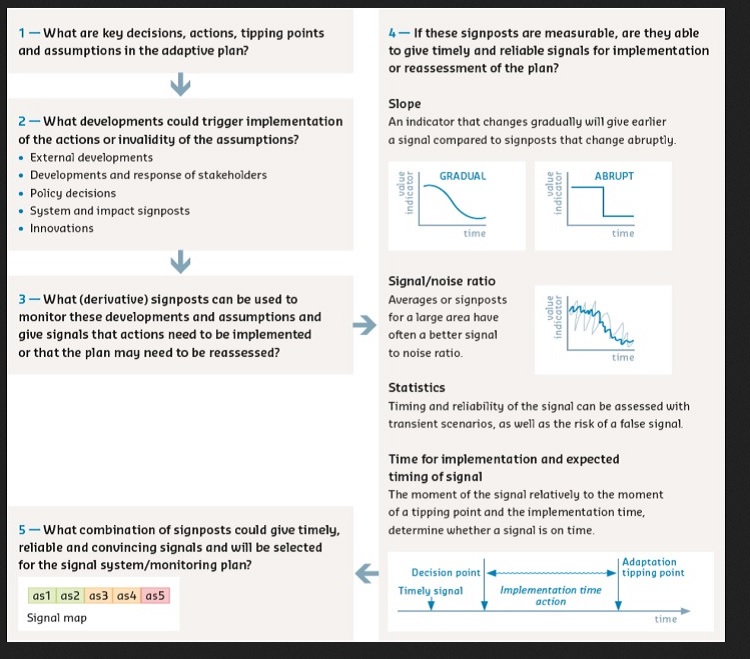

4. Identify trigger points, signposts and metrics (the value of an option depends on when it is exercised, ie first mover advantage; knowing when to move is important; as more 'unknowns unknown' become 'knowns', need to revise signposts, trigger points and metrics:

"...strategy must respond to unanticipated changes in market and competitive conditions..."

Michael Mankins et al, 2022

Can use stop-light signposts, ie green means go-ahead, yellow means proceed with caution, red means stop.

Below is a series of 5 questions that can help develop trigger points, signposts and metrics

(source: Marjolijn Haasnoot et al, 2018)

5. Provide prescriptive surveillance (need to constantly monitor and review performance; asked questions

- Do we need to change direction?

- What do we need to do?

Need to understand root causes of any performance shortfall; prepare contingency plans to handle any change in marketable competitive environments, like government policy, customer preferences)