Forecasting

. Involves subjective confidence as many experts do not know the limits of their expertise and are not judges of accuracy. They have intuitive skills in some of the tasks but have not learnt to identify situations and tasks in which intuition will betray them. The unrecognised limits of professional skill help explain why experts are often overconfident and wrong.

. If an environment is sufficiently regular and somebody has had the chance to learn these regularities, there is a strong chance that their predictions and decisions will be accurate. However, in an irregular environment, there is a strong chance that predictions and decisions will not be accurate.

. Short-term anticipation and long-term forecasting are different tasks.

. Planning fallacy = our estimates are closer to best-case-scenario than realistic assessment be improved by consulting the statistics of similar scenarios. Some examples of planning fallacy include

- the building of the Scottish parliament was estimated to cost 40 m pounds in 1997; yet the final cost was roughly 431 m pounds in 2004

- in 2005 study of railway projects undertaken worldwide between 1969 and 1998, over 90% had overestimated passenger usage

"...The relevant tendency to under weight or ignore distributional information is perhaps the major source of error in forecasting. Planners should therefore make every effort to frame the forecasting problem so as to facilitate utilising all the distributional information that is available..."

Bent Flyvbjerg as quoted by Daniel Kahneman 2012

. This is called "taking the other or outside view", ie reference class forecasting that involves large databases based on information from both plans and outcomes of hundreds of projects all over the world. This helps identify an appropriate baseline plus supplies statistics to generate baseline predictions and use specific information to adjust the baseline predictions.

. Irrational perseverance = sometimes we know the relevant data/information but do not think of applying it. We tend to ignore procedure that is guided by statistics and checklists, especially if it conflicts with our own point of view.

. Need to be careful of extrapolating in forecasting as unable to predict future events with any degree of accuracy as to be anticipated there is likelihood that something will go wrong.

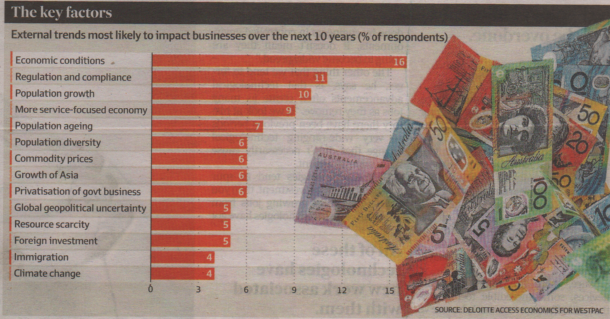

A good example of this is the forecasting of trends over the next 10 years was from a survey conducted in 2017. It shows how it can be very hard to make accurate predictions, ie no thought of a global pandemic dominating the world starting in 2020.

(source: Mark Eggleton, 2017)

. Just because something happened in the past, there is no guarantee that it will happen in the future.

Some more examples of inaccurate forecasts

Insurance companies

One Australian insurance company (IAG) has a poor record of forecasting catastrophes, ie

"...IAG underestimated its catastrophes cover in 10 of the 13 years to 2021..."

Chanticleer, 2022a

Reserve Bank

Below are some economic forecasts for Australia, made by the Reserve Bank of Australia (RBA), at the start of 2021 for that year and then actually what happened.

|

Actual

|

Forecast

|

Difference

(percentage points) |

|

| GDP Growth | 5 | 3½ | 1½ |

|---|---|---|---|

| Unemployment Rate | 4.2 | 6 | −1¾ |

| CPI Inflation | 3.5 | 1½ | +2 |

| Underlying Inflation | 2.6 | 1¼ | +1¼ |

| Wage Price Index | 2¼* | 1½ | +¾ |

|

(source: Philip Lowe, 2022) |

|||

Another example of inaccurate forecasting by the RBA was concerned with interest rate predictions. In early 2020, the RBA stated that it expected interest rates in Australia to remain low until at least 2024. It maintained this opinion in late 2021 (source: Katharine Murphy, 2021)

However, by mid-2022 it had started to regularly raise interest rates, eg 8 times in 2022. 10 monthly interest rate hikes in a row or 12 increases in 14 month!!!

NB Other central banks, like the US Federal Reserve and European Central Bank made similar inaccurate predictions, ie interest rates would remain low (source: Paul Barry, 2022).

A 3rd example is the RBA's inaccurate prediction over the years about Australian wage growth (see graph below)

(source: Daniel Ziffer as quoted in ABC TV News April 19, 2022)

The white line is the actual Australian wage growth path and the coloured lines are the RBA's predictions.

From 2013 onwards, the RBA's predictions were not very accurate!!!!

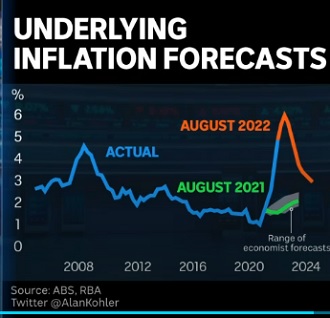

A 4th example is the RBA's inaccurate predictions on inflation over the years (see graph below)

(source: Alan Kohler quoted in ABC TV News September 8, 2022)

The blue line is the actual inflation rate while coloured lines are RBA's predictions in August of 2021 (green) and of 2022 (red) on future inflation rates; the shaded grey area represents the range of forecasts from other economists.

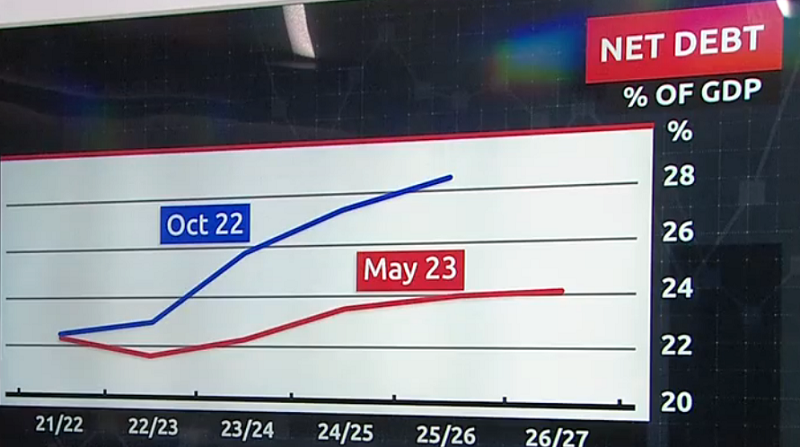

A 5th example is Australian public debt. The Australian Treasury in October 2022 predicted that net debt as a percentage of GDP would increase from around 22% to over 23% by May 2023; yet it fell to below 22%. This is a difference of around $A 40 billions!!!! It highlights the difficulty in predicting the future, even over the short-term of a couple of months.

(source: SBS, 2023)

Another example of poor forecasting by the Australian Treasury

"...in May, Treasury forecast a budget surplus of $4.2 billion for 2022-23. Six weeks later, just before the financial year ended, Treasury up the forecasts to about $20 billion. That adjustment of almost 500% in less than two months..."

Phillip Coorey, 2023

The above examples demonstrate the great difficulty in predicting the future with accuracy!!!

Despite forecasts or predictions being notoriously inaccurate, people seem to crave them.

One of the reasons people like forecasts and predictions is that it satisfies the brain's craving for certainty, ie knowing what the future will be, and having autonomy, ie control.

"...Consequently, clinging to predictions and believing we know what will happen in the future (and even control the future) provides comfort. Yet, all predictions are based on perspectives, models and often bias, which means they may be uncomfortable and even misleading......Yet as history has proven many times, it is hard to predict the future. At one time cars and electricity were considered a fad..."

Michelle Gibbings, 2022g

Weak Signals

We need to learn to make sense of 'weak signals', ie

"...A seemingly random or disconnected piece of information at first appears to be background noise but can be recognised as part of a significant pattern by viewing it through a different frame connecting it with other pieces of information..."

Paul Shoemaker et al as quoted by Michelle Gibbings, 2022g

Rather than trying to predict the future, we need to improve

"...your ability to understand what could happen by improving your peripheral vision, elevating self-awareness and minimising bias..."

Michelle Gibbings, 2022g

This involves using 3 phases

i) scanning (by tapping into information sources, extending your network and seeking out data, you can identify weak signals)

ii) sense making (using diversity of thought and participation to test hypothesis; canvassing wisdom from a range of people; developing diverse scenarios)

iii) probing and acting (continually probing and clarifying what could happen; confront the reality of the situation and encourage constructive dialogue)

"...for all this to happen, you need space to reflect and think, and time to generate insights and make sense of what is happening......It takes deliberate planning and conscious thought..... Need to be willing to challenge yourself and the assumptions that underpin how you think and decide...... you cannot predict the future..."

Michelle Gibbings, 2022g

However, you can plan for it. This requires a willingness to be flexible, resilient and adaptable.

. Baseline prediction = the prediction you make about something if you know nothing except the category to which it belongs. It is the anchor to further adjustments.

Psychological profile of good forecasters (Philip Tetlock at al, 2015)

| Philosophy |

Style |

Methods |

| - Cautious - Humble - Non-deterministic - Growth mindset - Much grit |

- Actively open-minded - Intelligent - Well read - Reflective - Introspective - Self-critical - Numerate |

- Pragmatic - Analytical - Creative - Multiple lenses - Probabilistic - Thoughtful - Diplomatic |

A good forecaster

"...active openness to new ideas and data, and a suspicion of standard or conventional answers..."

Charles Conn et al 2018

(source: Charles Conn et al 2018)