Technique 2.93 Cleaving Frames

Introduction

Successful problem-solving can involve using existing frameworks or theories as a more efficient and effective way to develop insights. It helps with problem disaggregation and can help with "what if" competitive scenario analysis plus determining the realist level of the assumptions that generated the results. Sometimes called "what you have to believe" analysis.

A toolkit of cleaving frames, elements and examples are listed in the below table

| Frames |

Elements |

Examples |

| Price/volume | Market share, awareness, trial, repurchase, elasticities | Product entry strategies |

| Collaborate/compete | Where to play, how to fight, acquiring a reputation, signalling | Any competitive situation |

| Market/ability to compete | Opportunity, competitive position, capabilities, resources | Entry/start-up |

| Invest/harvest | Growth/share, explore versus exploit, disruptive entrance | Portfolio of activities |

| Margins/asset turns | Returns on capital, valuing options | Business model construction |

| Scale/scope | Size vs breadth | Social media platforms |

| Capital/noncapital | Rent, phone, borrow, share, zero basing | Asset efficiency, gig economy |

| Principal/agent | Aligning, incentives, monitoring | Compensation, insurance, second-hand markets |

| Assets/options | Valuing potential (real and likely) | Multi-play investment games |

| Customer/shareholder | Competing perspectives | Stakeholder analysis |

Some examples include

- price/volume (focus on product/service pricing and volume that helped raise questions about the nature of competitive game, ie

i) Are there differentiated products or commodities?

ii) Are there competitive markets or are markets controlled by a few players?

NB need to understand assumptions around market share, new product entry, rate of adoption, and price and income elasticities)

- principal/agent (this becomes an issue when certain activities are done by agents (contractors, staff, etc) on behalf of principles (investors, managers, etc).

"...need to create incentive structures to align the interests of the principal and the agent, when the principal has incomplete visibility or control over the work of the agent. The best structure provides good, checkable results for the investor and fair income for the contract..."

Charles Conn et al 2018

- assets/options (every asset the company controls, purchases, et are options on future strategic moves that may have substantial value)

- collaborate/compete (

"...any business strategy needs to take account of potential reaction by rival firms..."

Charles Conn et al 2018

- regulate/incent (

"...policy makers often face the choice of adding legal regulation to address a problem, or using taxation, subsidies, or nudging policies that provide incentives for people or firms to adopt desired behaviour..."

Charles Conn et al 2018

- equality/liberty (choice between encouraging more equality amongst citizens vs allowing more individual freedom)

- mitigate/adapt (focuses on reducing harm from some causal factor)

- supply/demand (answers balancing questions such as "how can we get more" vs "how can we use less")

An example of cleaving frames is around social issues.

| Frame |

Elements |

Example |

| Demand/supply | Can we get more? Use less | water, CO2, energy, traffic, etc |

| Incidence/severity | Social risk: type, the level and risk of harm | terrorism, health care, bird flu, etc |

| Create/redistribute | Incentive, produce vs tax | tax, tax credits, capital gains, ownership, etc |

| Mitigate/adapt | Reduce harm, address harm, resilience | environment, climate change, violence, drug use, etc |

| Regulate/incentives | market design, property rights, regulatory design | cap and trade vs carbon tax, water rights, industry reservation, etc |

| Equality/liberty | community needs, individual rights | gun control, drug policy, etc |

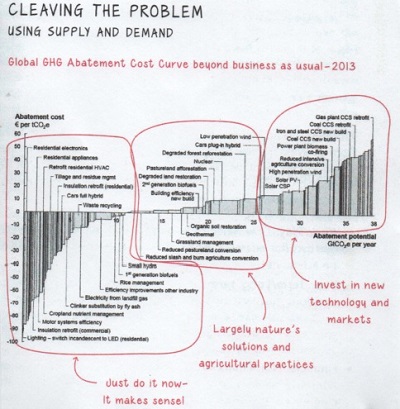

Another example of cleaving the problem

(source: Charles Conn et al 2018)

The above cost curve is around the demand/supply frame where the returns from, or cost of, abating CO2 are shown by the type of activity and the tons of abated, ie Read the curve from the left (low cost) to the right (high cost). This shows in the first group a large number of abatement activities which provide positive returns to private firms and individuals, ie much CO2 reduction can result from good education and supporting tax credit for investment costs. Further actions, mostly in agriculture and land use (including reforestation, degraded land recovery, avoided deforestation, etc) illustrate the investment costs are relatively small compared with the CO2 reduction benefits. The third grouping shows actions that are longer term and will require substantial private and social investment into new technologies and markets.

Cleaving can be used at a personal or individual level, ie

| Frame |

Elements |

Examples |

| Work/play | Leisure vs effort | choosing a career weight loss |

| Near term/long term | Spend vs invest | education solar panels retirement savings |

| Financial/non-financial | Values | where to live |

- work/play (how much/how long to work against nonwork interests, ie when to retire with adequate savings)

- near-term/long term (trading off near term decisions, like investing in education against longer term possibilities, ie what skills will be required in decades)

- financial/non-financial (financial includes cost-benefit, etc while non-financial can include social benefits/costs)

(source: Charles Conn et al 2018)